Renters Insurance in and around Las Vegas

Get renters insurance in Las Vegas

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Las Vegas

- Henderson

- Summerlin

- North Las Vegas

- Los Angeles

- San Francisco

- San Diego

- Phoenix

- Flagstaff

- Orange County

- Sacramento

- Reno

- Lake Tahoe

- Salt Lake City

- Park City

- St. George

- Cedar City

- Tucson

- Sedona

- Scottsdale

- Tempe

- Mesa

Home Is Where Your Heart Is

You have plenty of options when it comes to choosing a renters insurance provider in Las Vegas. Sorting through coverage options and providers to pick the right one is a lot to deal with. But if you want cost-effective renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy unmatched value and hassle-free service by working with State Farm Agent Julie Abarzua. That’s because Julie Abarzua can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including tools, musical instruments, mementos, souvenirs, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Julie Abarzua can be there to help whenever mishaps occur, to get you back in your routine. State Farm provides you with insurance protection and is here to help!

Get renters insurance in Las Vegas

Rent wisely with insurance from State Farm

Agent Julie Abarzua, At Your Service

Renters insurance may seem like the last thing on your mind, and you're wondering if it's really necessary. But take a moment to think about how much it would cost to replace all the stuff in your rented property. State Farm's Renters insurance can help when windstorms or tornadoes damage your valuables.

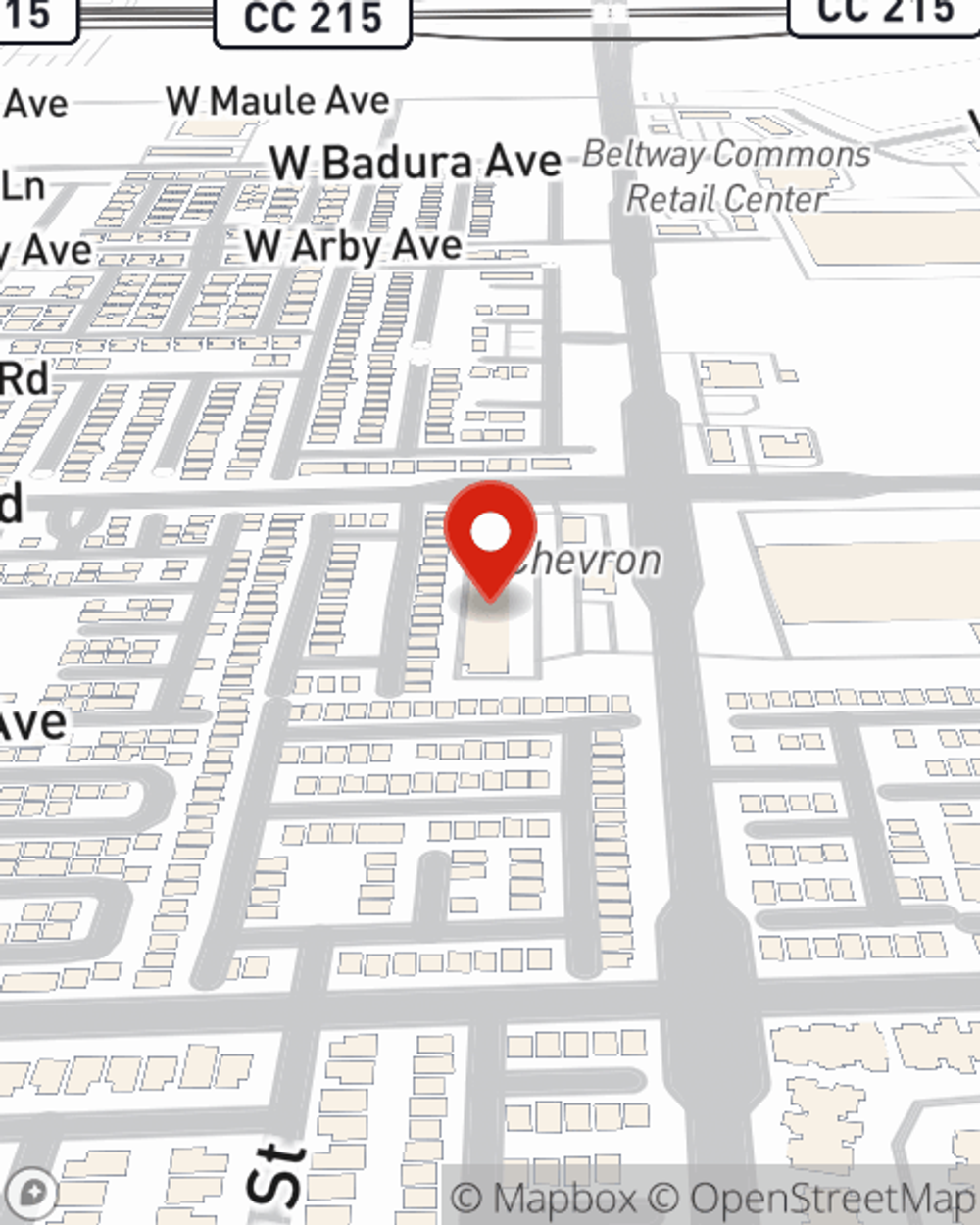

State Farm is a value-driven provider of renters insurance in your neighborhood, Las Vegas. Call or email agent Julie Abarzua today to learn more about coverage and savings!

Have More Questions About Renters Insurance?

Call Julie at (702) 212-0520 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Julie Abarzua

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.